Often the cost and impact of internal theft is downplayed because the true extent of the damage is not easily identified. There is a physical cost to theft, but there could be other impacts on the business such as damage to reputation or brand image as a result of staff actions.

A survey by the British Retail Consortium for the period 2014-2015 indicates just how much a business is likely to lose per incident of Employee theft compared to Customer theft.

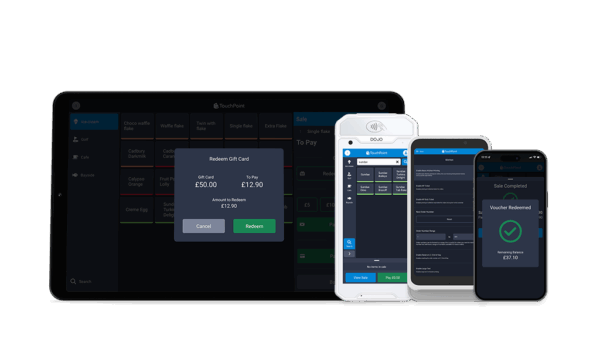

The value for employee theft only takes into account the amount they are caught with, over a period of months or years the amount stolen is likely to be significantly higher. Most insurers won’t cover you for fraud by staff members, unlike customer thefts. Introducing a system such as a new EPoS solution that will help monitor and prevent staff theft, is a decision that would soon pay for itself.

What Are The Risks?

An insider is any person who has inside access to your business, whether that is an employee, contractor or visitor.

Threats could include:

• Theft of goods, or fraud.

• Theft of customer data.

• Leak or misuse of confidential information.

• Facilitation of 3rd party access to IT infrastructure.

Any and all employees have the potential and opportunity to steal. Statistics from the American Society of Employers shows 55% of internal fraud in 2015 was committed by management.

- Managers may have been in the company for a number of years, hold a position of opportunity and may have the tools necessary to cover their tracks.

- Trusted members of staff and family members are perceived to be above suspicion when a theft occurs.

- New members of staff also have much to gain from theft and little to lose. Often blame will be pushed towards a customer as a convenient scapegoat.

There are several factors that can drive an employee to steal, and it isn’t always because of the potential financial reward. Consider staff that may have experienced a significant event such as a demotion, someone who shows character traits such as lack of conscientiousness, whether they have had previous incidents of security breaches or other historical patterns. Having the skills and opportunity to carry out fraud, or other activity is often the only motivation required.

Merchants of all sizes and sectors can deter, detect and mitigate the threat posed by insiders. ICRTouch have created a guide to help identify the signs that internal theft is happening within a retail or hospitality business, and track down those who may be responsible.