Background To MTD & VAT Returns

Historically this had been done manually by business owners, completing paper VAT return forms and sending them by post to HMRC. More recently, this has been done manually through an online form and sending this off digitally. However, this process still relied on manual input of details and the only real benefits were to timesaving and organisation.

This year, in an effort to reduce human-error with avoidable mistakes costing the Exchequer over £9 billion a year and to make it easier for the taxpayer to submit their VAT returns, the form will no longer be manually entered. As of 1st April 2019, it will instead be auto-generated from HMRC-recognised accounts software packages such as Sage50, Quickbooks or Xero, which will run the VAT return information and send it directly to HMRC. This is mandatory for all businesses over the VAT threshold.

Can Your ICRTouch System Help With This Process?

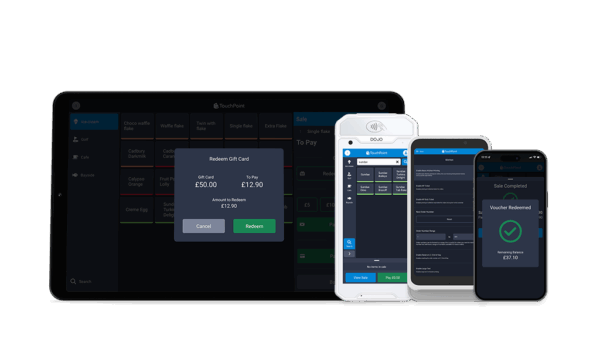

ICRTouch provide a link between TouchOffice Web+ and Xero, Quickbooks or Sage50. This link generates tax figures from all the sales information created by the EPoS system.

Your accounts package can then send the information onto HMRC digitally. No manual calculations need to be made, reducing human error and making the VAT returns process quick and easy.